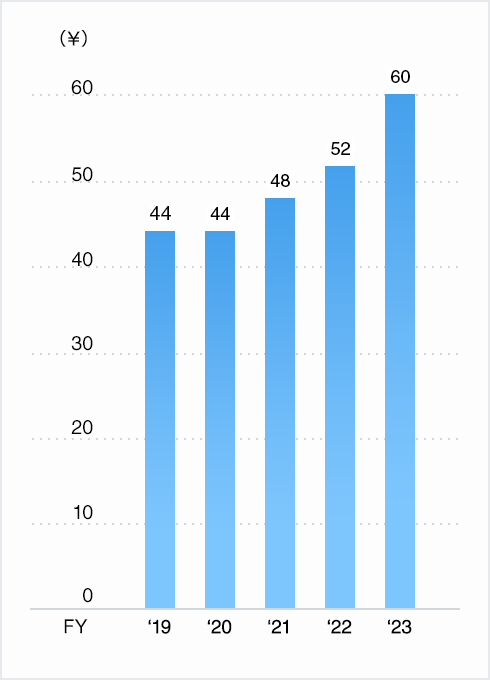

Dividends

Dividend Policy

(As of March 31, 2023)

Toyota deems improving shareholder returns as one of its priority management policies, and it will continue to work to improve its corporate culture to realize sustainable growth in order to enhance its corporate value.Toyota will strive for the stable and continuous increase of dividends.

With a view to surviving tough competition and transitioning to a mobility company, Toyota will aim to utilize its internal funds mainly for investment in growth for the next generation, such as environmental technologies to achieve a carbon-neutral society and safety technologies for the safety and security of its customers, and also for the stakeholders such as employees, business partners and local communities.

Considering these factors, with respect to the dividends for fiscal 2023, Toyota has determined to pay a year-end dividend of 35 yen (175 yen on a pre-stock split basis) per share of common stock by a resolution of the board of directors pursuant to Toyota’s articles of incorporation. As a result, combined with the interim dividend of 25 yen (125 yen on a pre-stock split basis) per share of common stock, the annual dividend will be 60 yen (300 yen on a pre-stock split basis) per share of common stock, and the total amount of the dividends on common stock for the year will be 816.9 billion yen.

Furthermore, Toyota resolved, at its board of directors meeting held on May 10, 2023, to repurchase up to 120 million shares of its common stock between May 18, 2023 and October 31, 2023 at a total maximum purchase price of 150 billion yen.

Toyota intends to repurchase shares flexibly by taking into consideration the price level of its common stock and other factors.