Nov. 08, 2017

First Driving Behavior-based Telematics Automobile Insurance Developed for Toyota Connected Cars in Japan

Aioi Nissay Dowa Insurance Co., Ltd.

Toyota City, Japan, November 8, 2017―Toyota Motor Corporation (Toyota) and the MS&AD Insurance Group's Aioi Nissay Dowa Insurance Co., Ltd. (Aioi Nissay Dowa Insurance) have jointly developed Japan's first driving behavior-based telematics automobile insurance. The plan is available to owners of certain units of Toyota connected cars*1, and uses driving data gathered via telematics*2 technologies to adjust insurance premiums based on the level of safe driving every month. Total insurance premiums comprise a combination of basic insurance premiums and usage-based insurance and, under this new plan up to 80 percent*3 of usage-based insurance premiums can be discounted. In addition to driving behavior discounts, various services are to be provided under the concepts of "enjoyment," "benefits," and "safeguards." The service is scheduled to go on sale on January 15, 2018, while insurance liability is scheduled to commence in April 2018.

Both Toyota and Aioi Nissay Dowa Insurance intend to contribute to the realization of a safe and secure traffic environment for society through the development and provision of telematics automobile insurance that utilizes connected cars and automobile big data.

*1Vehicles that are equipped with navigation systems from which Toyota can gather driving data, and which have the ability to connect to the internet, are eligible for the new insurance plan.

*2Derived from the words "telecommunications" and "informatics," "telematics" refers to systems that provide various types of information and services using vehicle onboard devices, such as navigation systems and GPS, and mobile communications systems.

*3The discount rate for the entire premium depends on the annual mileage. For example, if the annual mileage is 8,000 km the discount will be about 9 percent

- Development background and aims

The advance of telematics technologies has led to major changes in the automobile landscape, such as the creation of a variety of new products and services that utilize automobile driving data.

Overseas, particularly in Europe and the U.S., there has been an increase in the number of automobile insurance policies that utilize telematics technologies to provide discounted insurance premiums based on levels of safe driving. In Japan, too, the government is advocating the use of automobile insurance that leverages telematics technologies as a means of reducing the number of accidents. Consequently, automakers and IT companies are engaged in lively competition for technological development.

Aioi Nissay Dowa Insurance is a pioneer of telematics automobile insurance in Japan. In 2004, the company launched a distance-based automobile insurance that utilized Toyota's telematics technologies. In March 2015, it purchased Box Innovation Group Limited (BIG), a major U.K. telematics insurance company, and has taken advantage of its newly acquired knowhow to research and develop the latest telematics automobile insurance and services.

Toyota has declared the three pillars of its connected strategy to be: connecting all cars; the creation of new value and business revolution; and the creation of new mobility services. Through the development of connected cars, which are equipped with data communication modules (DCM) required for transmitting data, Toyota provides connected services that utilize big data. This has enabled the company to engage in the creation of new value for a mobility society and, at the same time, to aim to realize the ultimate goal of eliminating traffic fatalities and injuries. To this end, Toyota has promoted the development of advanced safety technologies such as Toyota Safety Sense and ICS, increased the number of models equipped with these technologies and, together with Toyota dealers, commenced Support Toyota programs―educational traffic safety activities aimed at enhancing customer safety and peace of mind.

The telematics automobile insurance developed jointly by Toyota and Aioi Nissay Dowa Insurance utilizes a variety of driving data gathered from Toyota's connected cars. By including driving behavior discounts via telematics technologies, and by providing a safe and secure service that benefits all drivers, the two companies aim to realize a safe and secure traffic environment for society.

- Overview of new products and services

The new insurance plan was jointly developed by Toyota and Aioi Nissay Dowa Insurance with the aim of realizing a safe and secure traffic environment for society, and of providing their customers with a fulfilling car life based on enjoyment, benefits, and safeguards. The insurance plan forms part of the appeal of Toyota's connected cars.

- Product name

- Toyota "Tsunagaru" (Connected) Car Insurance Plan (eligible: Toyota dealers)

- G-Link automobile insurance (eligible: Lexus dealers)

- Eligible vehicles

Toyota connected cars (including Lexus vehicles) from which Toyota can gather self-determined driving data.

-

- Toyota

- The line-up will gradually be expanded, beginning with the Crown, which is scheduled for launch in summer 2018

-

- Lexus

- All new models sold from January 2018 onwards are eligible (excluding the HS and LC; certain existing models are also eligible)

-

- How the service is provided

Toyota's connected cars automatically transmit a variety of car-related data via a DCM to the Toyota Smart Center. Utilizing this vehicle driving data, Aioi Nissay Dowa Insurance will provide a new service that is unique to Toyota vehicles.

- Features of the insurance plan

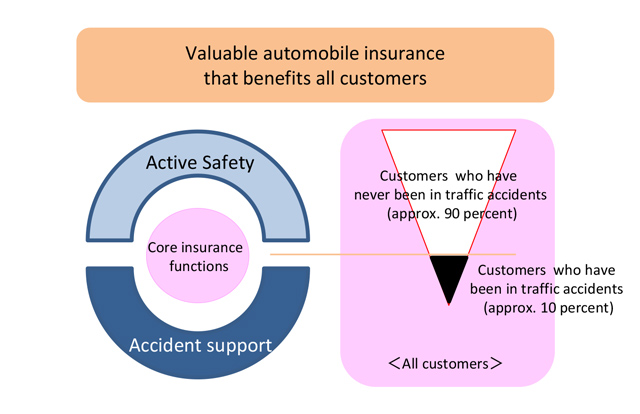

Until now, automobile insurance plans have focused on providing peace of mind to customers whose actions had caused traffic accidents. However, by providing a service that makes use of telematics technologies, Aioi Nissay Dowa Insurance aims to generate added value (active safety) for customers whose actions have not caused traffic accidents.

The company provides each customer with a safe driving diagnosis service in a timely manner in order to encourage safe driving and prevent traffic accidents from occurring.

The enjoyment of safe driving

- Drive Report

- Tips that can be checked after every drive

- Safe driving score and tips

After each drive, the driver's speed, acceleration, and braking are evaluated on a five-point scale. A combined safe driving score out of 100 is also provided.

- Drive report map

The report map enables drivers to verify both the route taken and locations where dangerous driving was detected and provides simple tips on each aspect of the user's driving.

This feature enables drivers to review their drives immediately after they have finished and encourages safe driving.

- Vehicle information alerts

These alerts provide information on the operational state of active safety devices, tire pressure, electronic key charge status, among other items.

The feature not only supports safe driving, but also helps keep the car in a safe and secure state.

- Monthly report

- Detailed evaluation that enables drivers to review their monthly driving results

- Safe driving score and insurance premiums

The driver's speed, acceleration, and braking are evaluated on a five-point scale based on the monthly driving conditions. A combined safe driving score out of 100 is also provided.

Insurance premium discounts are determined based on the driver's safe driving score.

- Safe driving advice

Detailed feedback is provided based on the previous month's driving data. Feedback is personalized for each customer and depends on his or her driving characteristics.

The benefits of safe driving

The new, to-be-launched discounts based on driving characteristics are deducted from insurance premiums according to monthly driving distance and driving characteristics (with negatives including excessive speed, sudden acceleration, and sudden braking being taken into account). This information is based on driving data gathered via Toyota's connected cars.

There are no eligibility restrictions based on contract conditions, such as driving a car that is not part of a commercial fleet or being a new or existing customer. For this reason, individuals who possess a Toyota connected car are eligible for the plan, and are eligible to receive "driving behavior discounts = safe driving incentives" on top of any existing discount rates.

- Example of insurance premium

In the case of an insurance plan in which the insurance rating is 10, the period in which the accident coefficient can be applied is zero years, vehicle operation is restricted to drivers 26 years of age or higher, and annual driving distance is capped at 8,000 km.

Safeguarding loved ones

- Automatic emergency report service

Previously, when customers were involved in an accident, they had to call their insurance company themselves.

However, under this plan, if a large collision is detected, staff at a specialized Automatic Report Desk place a "safety confirmation phone call" and make any necessary arrangements in a speedy manner to reduce the burden on the customer.

Also, customers can opt not to receive safety confirmation phone calls, in which case Aioi Nissay Dowa Insurance will then send emergency contact information by email. When directly contacted by the customer, the company will make emergency tow truck arrangements, accident reports, and rental car arrangements as necessary.

When customers encounter difficulties with accidents or have inquiries, Toyota's T-Connect operator service, Lexus' Lexus Owners Desk, and Aioi Nissay Dowa Insurance's dedicated help desk coordinate with each other to provide seamless support.

- Safeguard Support

- Notifying family members in the event of an accident

- Information sharing service for family members

The safe driving score, evaluation of driving characteristics, and safe driving advice can be provided in the form of a monthly report sent by email to families worried about children who have recently acquired driver's licenses, parents living far away, or other parties. This enables family members to monitor the customer's driving habits and allows the service to be used in activities aimed at safe driving.

Also, in the event of an accident, the results of the initial response to the accident, such as details of the accident and whether there were any injuries, are sent by email.

Customers will be notified of their national ranking in terms of their safe driving score, as well as their ranking among drivers of the same car model, age, and prefecture.

A Safe Driving Campaign will also be implemented, and customers who achieve score and ranking thresholds will be given prizes.

This service aims to enable customers to experience the joy of driving, and to promote safe driving while having fun.

- Commencement of sales

Sales of the new insurance plan are scheduled to commence on January 15, 2018. Insurance liability is scheduled to commence in April 2018.